Real Estate Analytics Use Cases

25 May 2021 | 2 min read

Data analytics is a thriving industry today, but many people still underestimate how powerful it can be for the real estate sector. Today we’re going to be looking at the most compelling use cases for real estate analytics.

Identifying Subtle Trends

One of the significant benefits of real estate analytics software is that it is powered by machine learning and AI.

Why is this a benefit? Because we as humans can only think like a human. In other words, our experience limits us to looking for the patterns we expect to see. Additionally, people can often miss the more subtle trends that are hidden deep within the data. By contrast, analytics software is trained to spot subtle and not yet identified patterns. These subtle trends can be the difference between making a small profit and making a considerable profit for property investors and developers.

Real estate analytics software can identify subtle trends using a variety of traditional and non-traditional data. Examples of non-traditional data include:

- The tone of Yelp reviews for local businesses.

- The energy consumption of the building compared with similar structures in the same zip code.

- The number of permits granted to build swimming pools (an indicator of wealth).

- The change in the number of coffee shops within a specific radius of the property.

The value of a property can decrease or increase based on unusual factors that many investors and developers don’t initially consider. For example, over the last ten years, apartments in Seattle within a mile of specialty grocery stores like Whole Foods appreciated faster. Real estate analytics software spots these kinds of trends before they are common knowledge so investors can take action.

Improving the Home Search Experience

In 2018, 44% of people looked for properties online first. Considering the world was pushed more forcefully online during the COVID-19 pandemic, it’s safe to assume that number is even higher today. With so many people searching for homes online, it’s paramount that real estate companies provide compelling digital experiences that meet user expectations.

Searching for a property can be personal and complex. While consumer segmentation can be useful in real estate, it’s often less powerful than in other industries. Why? Because properties are high-value infrequent purchases.

This means that while a clothes company can use consumer segments like age, gender, geography (hot/cold climate), lifestyle (faux fur coats for the socially conscious, camouflage for hunters, etc.), in real estate, it’s more complex. For example, first-time buyers typically purchase smaller and cheaper homes, but this still varies greatly based on income.

Likewise, people with children will normally seek more space than those without children in their age range, regardless of whether other factors align. And other specific preferences also play a part. For example, whether someone prefers traditional properties with period features like original stone, fireplaces, and hardwood floors, or whether they want an open-plan new build with tons of natural light.

Real estate analytics takes the mystery out of returning the right results to users because it promotes hyper-personalization. It uses various data, including historical data, previous search data, and even advanced AI-like computer vision. Algorithms can now identify user preferences like color palettes, floors, construction materials, and more, based on how long the user interacts with certain listings and images.

By analyzing real estate data, real estate companies are also able to improve their websites to align better with how users like to browse. For example, users today are often much more specific in how they search. They are more likely to search for “2 bedroom apartments in New York with a balcony and fireplace” than simply “2 bedroom apartment New York”.

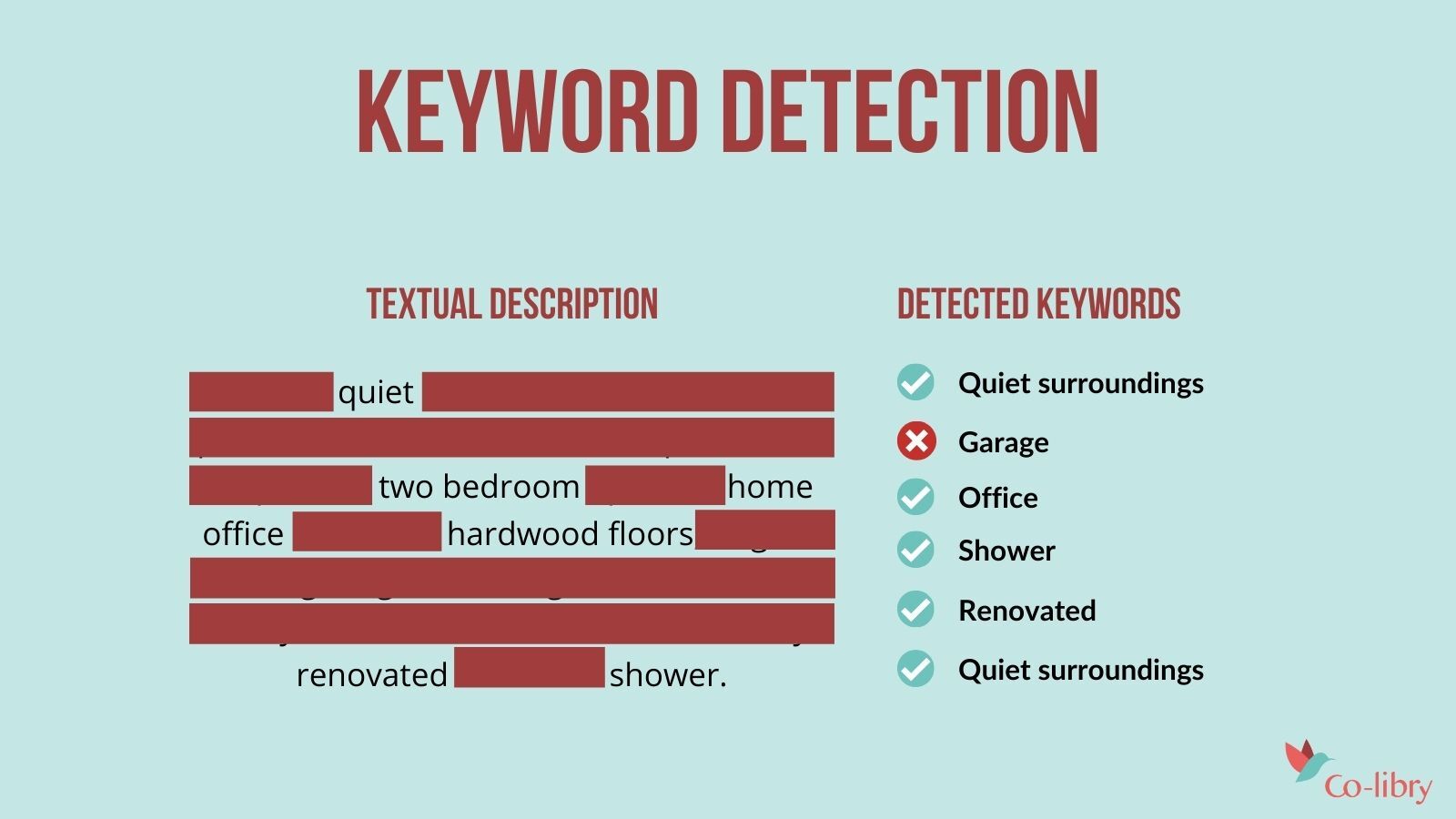

The search results need to be highly relevant to the user’s search to prevent them from bouncing off the site. The challenge for real estate companies is that sometimes this relevant information is hidden in the metadata, images, or property description rather than the core property details. In this situation, ideal properties might appear far down in the search results or not appear at all. Real estate analytics software solves this problem because it can analyze all data related to the property and tag/highlight relevant features.

Of course, with these examples, we are just scratching the surface of what is possible with AI and machine learning.

Automated Valuations

Automated valuations (where a computer algorithm determines the value of a property) are becoming more common. When valuations are done manually, there’s much more room for bias or error. With an automated system, valuations are made using a statistical model that uses many hundreds of factors to determine a fair price. And fair is the keyword here – automated valuations ensure that everyone is treated equally. There are also other benefits to automated valuations, including speed and cost. Valuations that would take days manually can be done in minutes. And without the additional labor costs of hiring a professional to visit the property, costs are vastly reduced.

Preventing Budget Overruns

For property developers, budgets are critical. However, it’s also true that many developers run over budget, and this eats into their profits when they come to sell the property. With real estate analytics and AI, software can now make advanced predictions for construction budgets. It does this by analyzing the condition of the site, materials present, and more, and cross-referencing this with local suppliers to source new materials. It can also use any available data from similar projects to make recommendations.

Data Visualization

People are famously bad at being able to read data on a page. For developers and investors, being able not just to source relevant data but also understand it is critical. A major benefit of real estate analytics software is that it often comes with visualization and representation features that make data easy to understand with just a glance.

Summary

By investing in real estate analytics software, real estate companies stand to gain in many areas. They can get more from their data, provide compelling digital experiences, provide more robust data for developers and investors, and more.

Do you want to get more high-quality contact requests? Get our ebook now, learn how industry leaders and e-commerce are using data & personalization to gain more relevant leads.

How House Alerts Help To Obtain Higher Click-Through Rates

Thanks to house alert systems, you can quickly inform potential buyers when new properties that match their criteria show up. Here is a step-by-step guide that will show you how you can retarget potential customers and help them find the house of their dreams.

Two Unique Dashboards That Will Help Your Real Estate Agents Close More Deals

Being successful in sales is about knowing your product inside out and knowing everything there is to know about your customer. Luckily, it’s easier to achieve these two goals today than ever before by using some unique dashboards. Read everything about it here:

How Artificial Intelligence is Shaping the Online Real Estate Market

Now in 2021, the message is clear; AI is here, and it’s here to stay. But what impact does this technology have on the real estate market? Read everything about it in this article